Your KYC AI Investigator

Leverage AI to streamline your KYC workflows, reduce processing times and operational costs.

Kai revolutionises KYC and Financial Crime case management with cutting-edge GenAI technology

Features

We leverage cutting-edge technology to liberate your analysts to complete high value work.

Effortless integration with existing systems and data sources for rapid deployment.

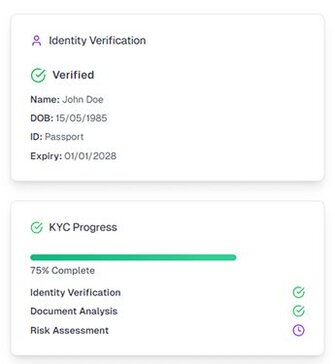

Streamline your customer onboarding journeys, reducing manual effort and increasing accuracy.

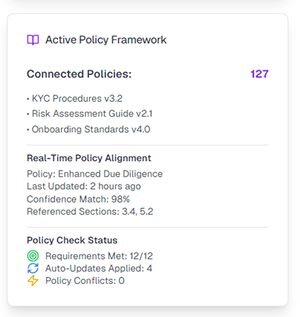

Regulatory Compliance

We support you in safeguarding your enterprise with guardrails and audit trails that ensure you have auditable and explainable decisions.

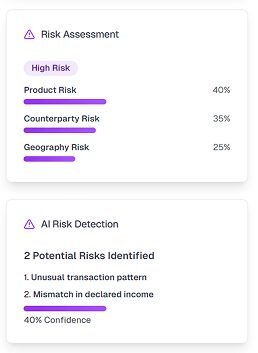

Real-time analytics and reporting providing actionable compliance intelligence.

journeys, which utilise various prompt engines to

efficiently complete the journey in detail.

engines, data gathering steps, and external service

calls, such as identity providers to thoroughly examine

the triggered event.

understand customer behaviours and relationships

c.2024 bigspark.ai All Rights Reserved.